Economic Outlook

Prosperity and Uncertainty

- US enters 2025 with strong momentum in growth, jobs

- All elements of economy subject to changes in policy

- Interest rates still somewhat restrictive

- Progress on inflation stalled

Growth

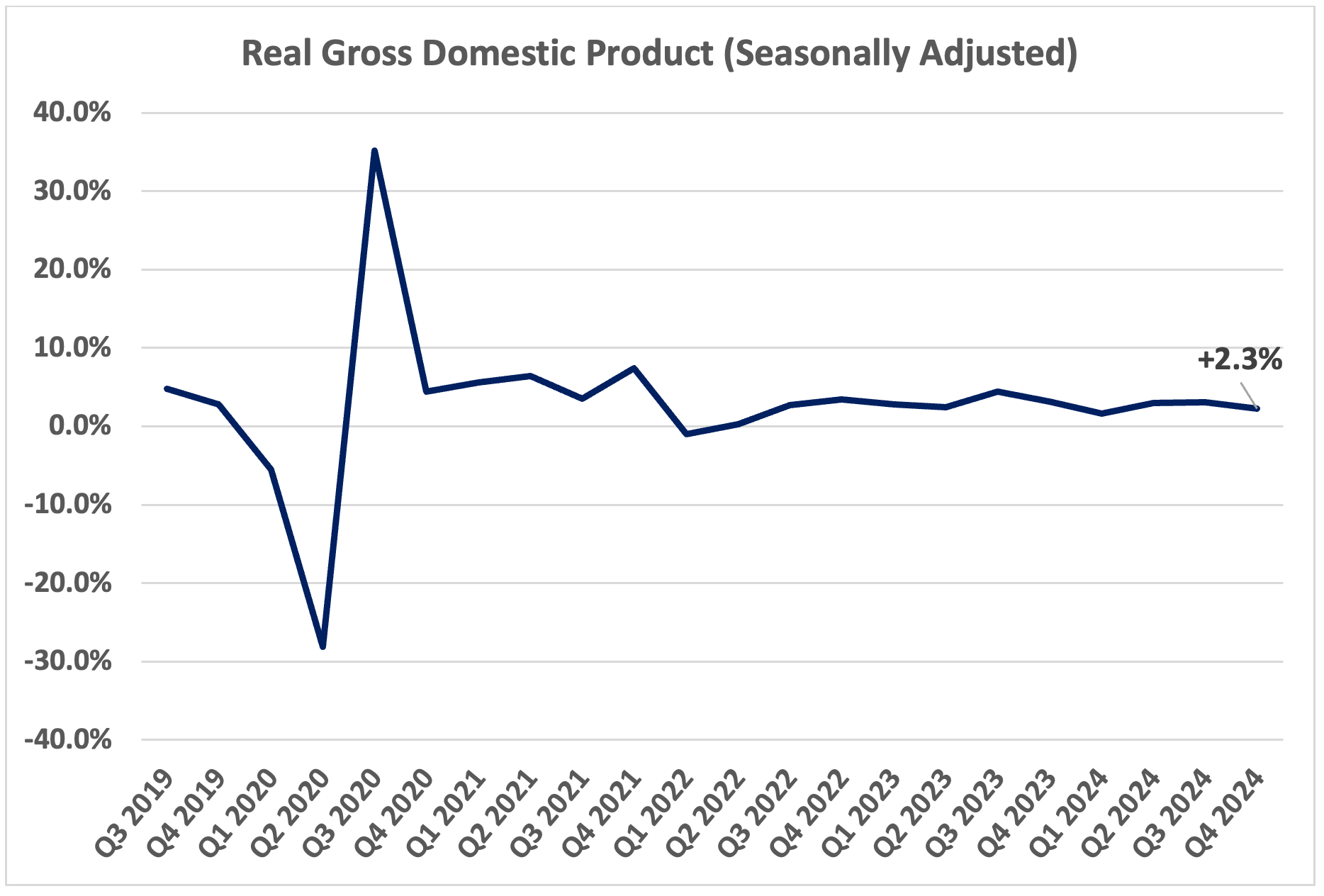

- US Real GDP came in at 2.3% for Q4 2024

- GDP grew 2.8% for all of 2024 vs 2.9% for 2023

- US still leads the developed world in growth

Real GDP for the US came in at a solid 2.3% in the fourth quarter of 2024, based on the first estimate, and 2.8% for all of 2024. Consumer spending, which has been the mainstay of this expansion, continues to be strong. Inventory expansion, which detracts from GDP, kept the overall result from being even stronger. Businesses appear to be stockpiling goods ahead of threatened tariffs. By way of comparison, the post-pandemic average quarterly growth has been 3.2%. Net imports, which also subtract from GDP, were neutral but could be revised in future releases since they appear slightly at odds with the inventory build. Residential investment and government spending contributed to GDP growth; business fixed investment was negative. Overall sales grew 3.2%, signaling broad underlying strength in the US economy.

The US enters 2025 as the envy of the developed world. The advanced economies as a group are estimated to have grown 1.8% in 2024. The US is benefiting from a strong domestic consumer economy as well as supportive demographics relative to other developed nations. As a net importer, it has also benefited from a strong dollar, supported in part by higher interest rates. Within the US economy, services have been an engine of growth while manufacturing has lagged. Services make up almost 70% of the US economy.

A moderation of government regulation on business could spur increased growth in the US economy. Regulations, whatever their merits, add to the cost of doing business. They can be a drag on innovation and discourage mergers and acquisitions. Although a relaxation of regulation may take some time to work through the economy, the anticipation of a more business-friendly environment may also spur near-term business investment.

Tariffs, if imposed to the full extent threatened, could be a near-term drag on US growth. Tariffs, like any cost of business, are either paid by the end consumer or subtracted from profit margins. Generally, they are paid by the importer, not the exporter. Some analysts estimate that tariffs, if imposed to the extent indicated, could deduct as much as 1% from the ensuing 12-month GDP, with a time lag. Tariffs can constrain growth by adding to input costs and by way of retaliation from our trading partners.

The threat of tariffs is probably pulling forward some building of inventories and generating enough uncertainty to constrain certain types of business investment. If the threat of tariffs brings our trading partners to the bargaining table and results in more open access to foreign markets, they could also have a positive impact on future growth.

A reduction in federal spending could have some very positive effects on interest rates and the availability of capital for economic growth. It is a net positive. However, federal spending comprises about 23% of GDP, so its reduction could also engender somewhat lower growth in the near term. A meaningful portion of the economic growth of the last five years has been a by-product of very generous monetary and fiscal stimulus. In the long run, private investment produces more sustainable growth than fiscal stimulus.

Employment

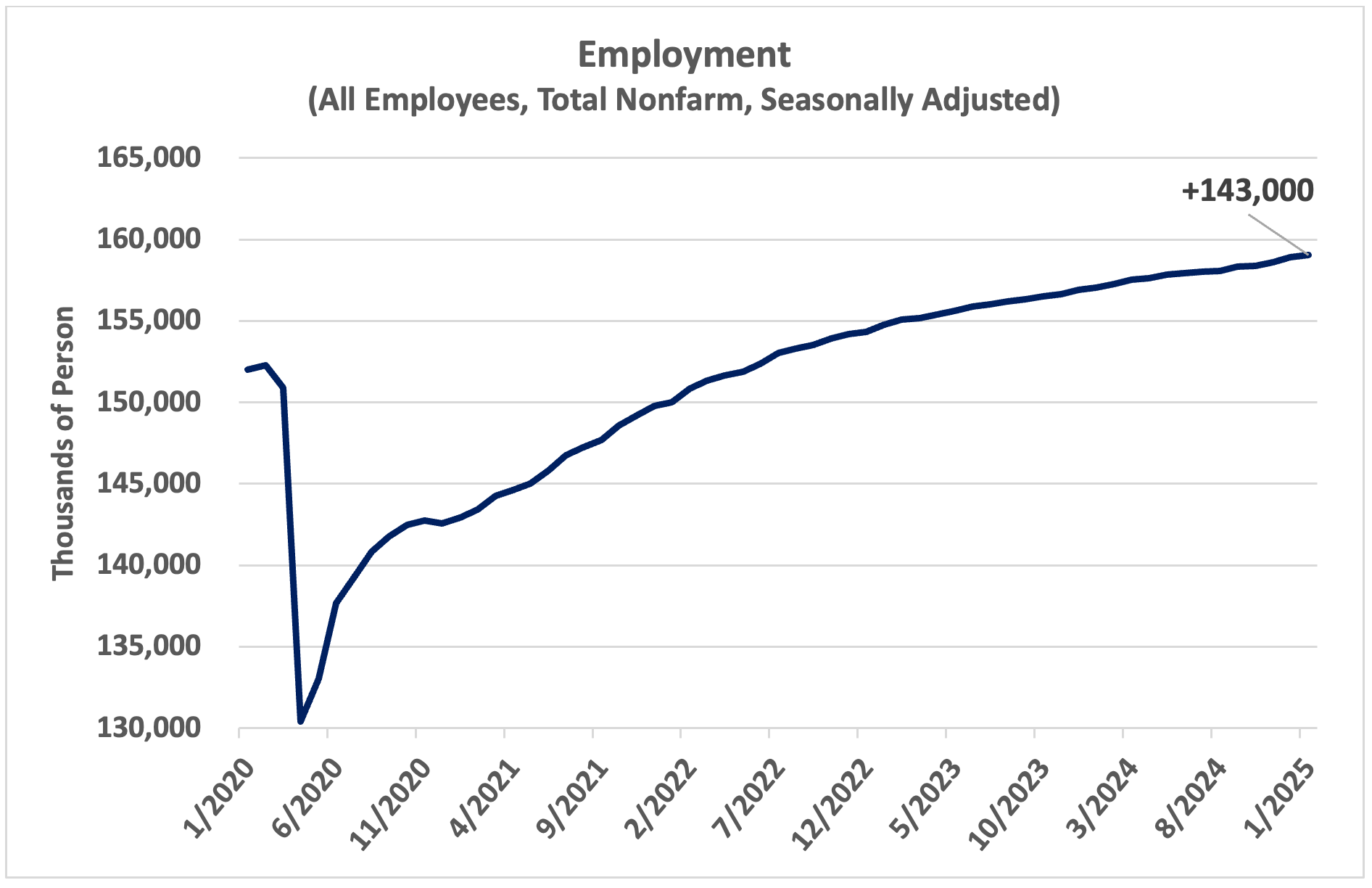

- Payrolls increased 143,000 in January

- Annual revisions tempered job gains in 2024

- Unemployment ticked down to 4.0%

The US economy added 143,000 jobs in January, a moderate showing compared to the second half of 2024. Annual revisions to employment measures resulted in lower payroll additions for much of 2024. The US needs to add about 100,000 jobs per month just to absorb the current rate of growth in the workforce. The unemployment rate ticked down to 4.0%. Overall, job creation is good, just not as strong as it was in the immediate aftermath of COVID. Unemployment remains low, although slightly above its lowest rates from the past five years.

The Federal Reserve has been trying to tamp down inflation with higher interest rates. Typically, such action also constrains job growth and can trigger a recession. In the current tightening cycle, most of the impact on jobs has been in a reduction of open positions rather than a significant increase in the jobless rate or a drastic decline in job formation. The number of job openings decreased by over half a million in December and 1.3 million over the past year. In mid-2022, there were two job openings for every unemployed person. Now, that ratio is down to just over one. Having tight monetary conditions impact openings is far preferable to a rise in unemployment or a collapse in hiring.

Average hourly earnings are growing at 4.1%. This is a rate high enough to support continued spending by the consumer, but not so high as to create new inflationary pressures. Productivity has been increasing in the US; labor productivity increased 1.2% in the fourth quarter of 2024. Improving productivity cures a lot of potential ills in the economy. It supports growth, and it is a powerful antidote to inflation. Artificial intelligence (AI) has the potential to sustain improving productivity, even if its potential is served up with a full dose of hype.

Tighter immigration controls could tighten labor markets and increase the cost of filling open positions. Agriculture, hospitality, and construction may be especially vulnerable to these impacts. And at the high end of the pay scale, medical services and technology could also be impacted. This is not to argue against the enforcement of immigration rules; it is simply to point out that all policy decisions have economic implications.

Inflation

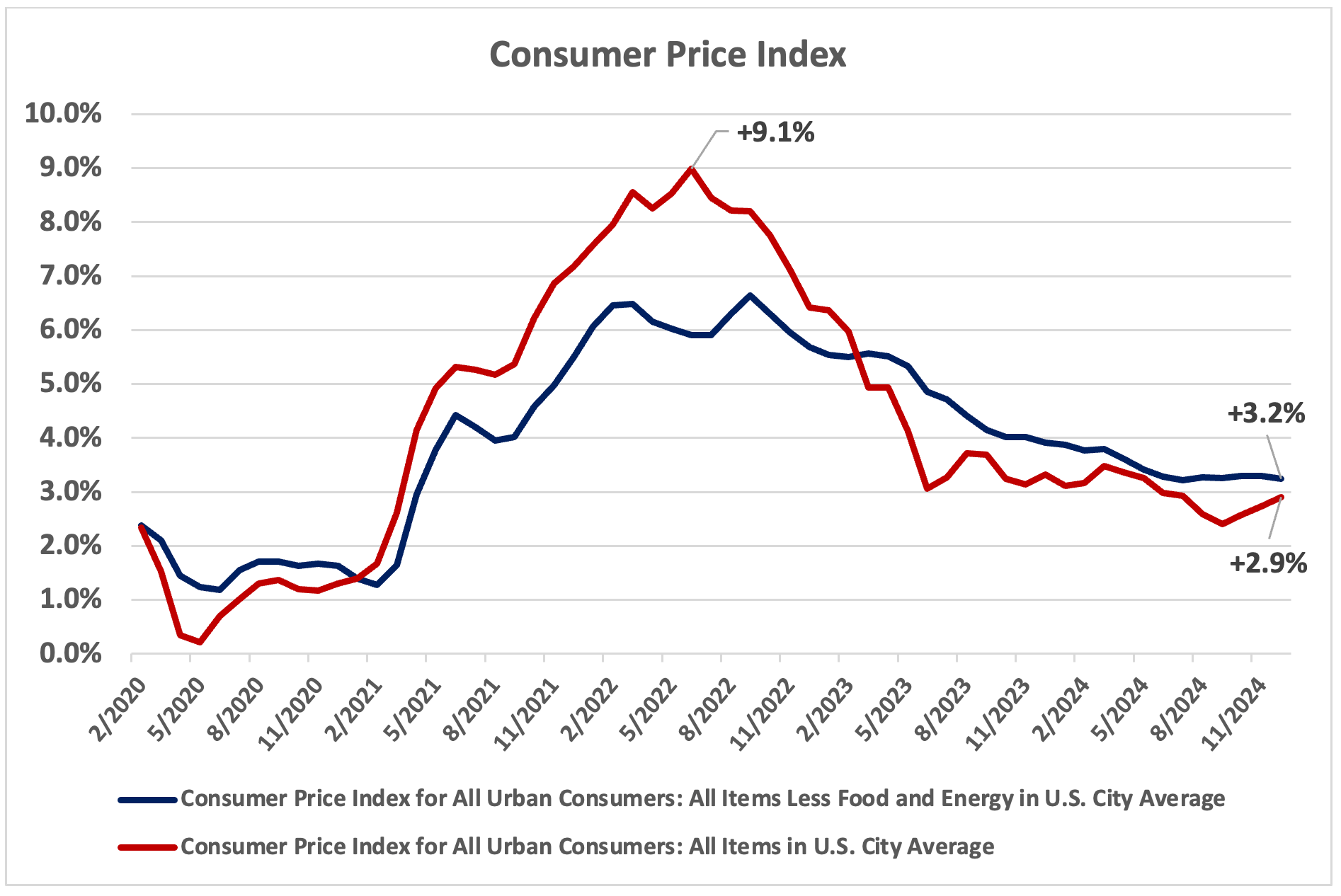

- Broad inflation up in December; “core” edged down

- “All items” CPI came in at 2.9%

- Core CPI was at 3.2%

- Inflation not giving up easily

December inflation came in at 2.9%, as measured by the “all items” CPI. It was as low as 2.4% last September. Energy, which had been helping our inflation picture during most of 2024, was up 2.6%. Gasoline was up 4.4% in December. Food and medical services were up incrementally in December, and apparel was flat. The Federal Reserve’s preferred inflation measure, the PCE index, was up 2.6%, and the “core” PCE index held steady at 2.8%. Overall, inflation measures appear to have hit a sticking point here. Much of the progress realized last year corresponded to energy prices coming down. That appears to have run its course. We have indicated in the past that the “last mile” down to the Fed’s target of 2.0% inflation would be the most difficult, and this is proving true. One of the key reasons the Fed has transitioned from cutting interest rates in the Fall to remaining on hold in the early months of 2025 is that inflation, which had been on a downward trend, has now flattened out. The Fed will want to see further progress on inflation before implementing additional cuts. Tariffs could have a direct and negative impact on inflation.

Tariffs make imported goods and parts more expensive, and the cost of tariffs is typically passed on to the consumer. Many of the goods manufactured in the US are assembled using imported parts or imported raw materials.

Interest Rates

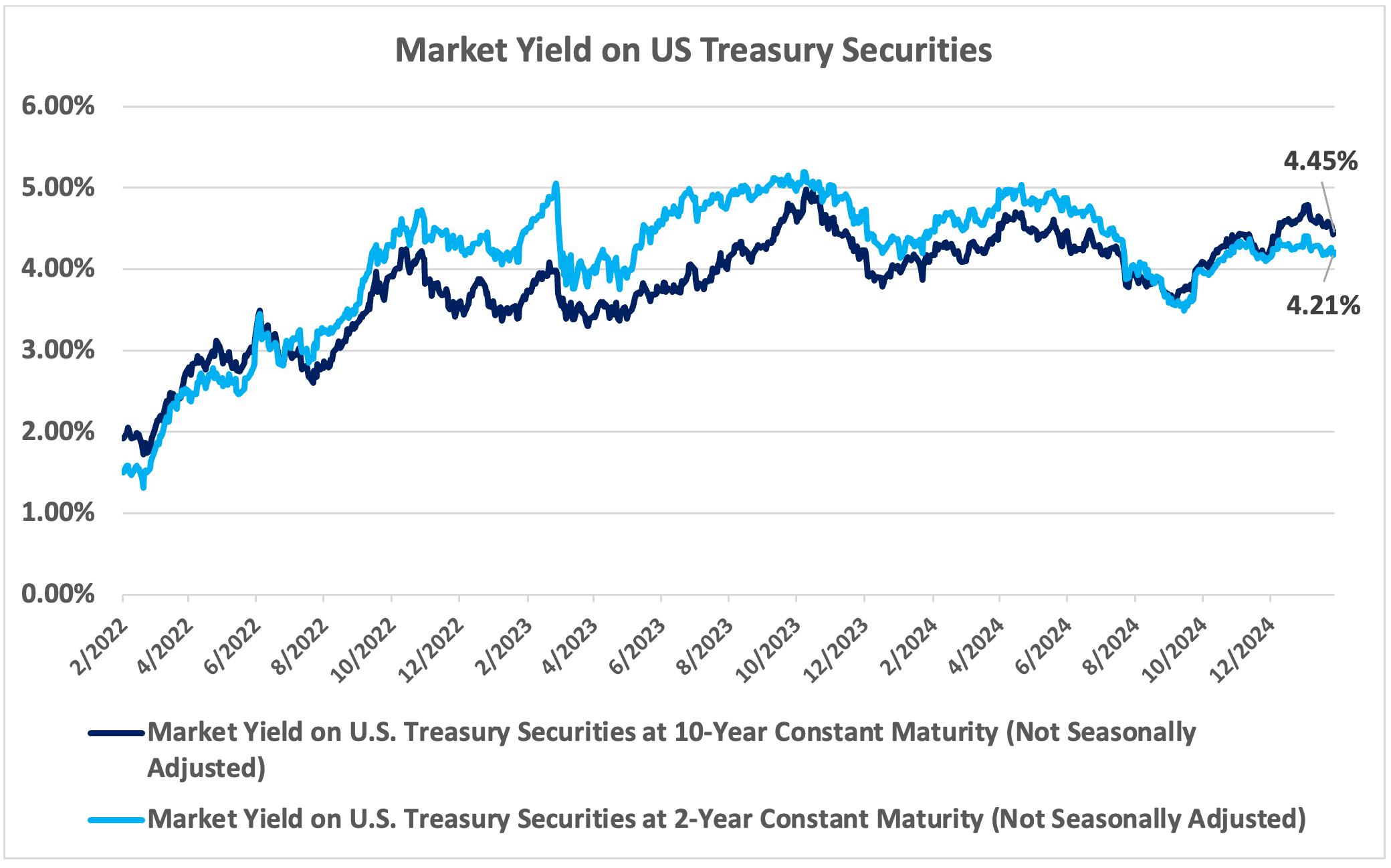

- Federal Reserve is on hold

- Short-term target rate was cut by 1.00% to 4.50 at the end of 2024

- Key 10-year Treasury rate is up since September ‘24

The Federal Reserve’s Open Market Committee met on January 28 and 29 and left their target for short-term rates unchanged. The upper limit of that target was 5.50% at the beginning of September. It now stands at 4.5%. Policy uncertainty and inflation’s stubborn hold above the Fed’s target of 2% are factors that argued for a “pause” here. Although widely debated, many analysts now believe that the Fed may remain on pause through this coming summer.

The yield on the 10-year Treasury, which is much more important to benchmarking mortgages and other loans, rose to 4.8% in early January but has since settled closer to 4.5%. The 10-year had touched 3.6% last September. Longer bond yields have not come down as much as short-term rates because markets are concerned about the continued deficit spending of the US Government. If the current administration is successful in curbing deficit spending, it would not be unreasonable to expect intermediate-term bond yields and loan costs to come down as well. A reduction in deficit spending could have a lasting, positive impact on the cost and availability of capital in the US. All else equal, direct reductions in government spending reduce deficits. Tariffs can help reduce deficits by increasing government revenues. Tax cuts can increase deficits by decreasing federal revenues, but they can also stimulate spending and economic growth. The net effect of multiple policy actions comes down to their proportional impact. Taxes on business and personal income dwarf even the most dramatic tariffs threatened, and only about one-quarter of the federal budget is “discretionary” and, therefore, more susceptible to cuts.

Markets

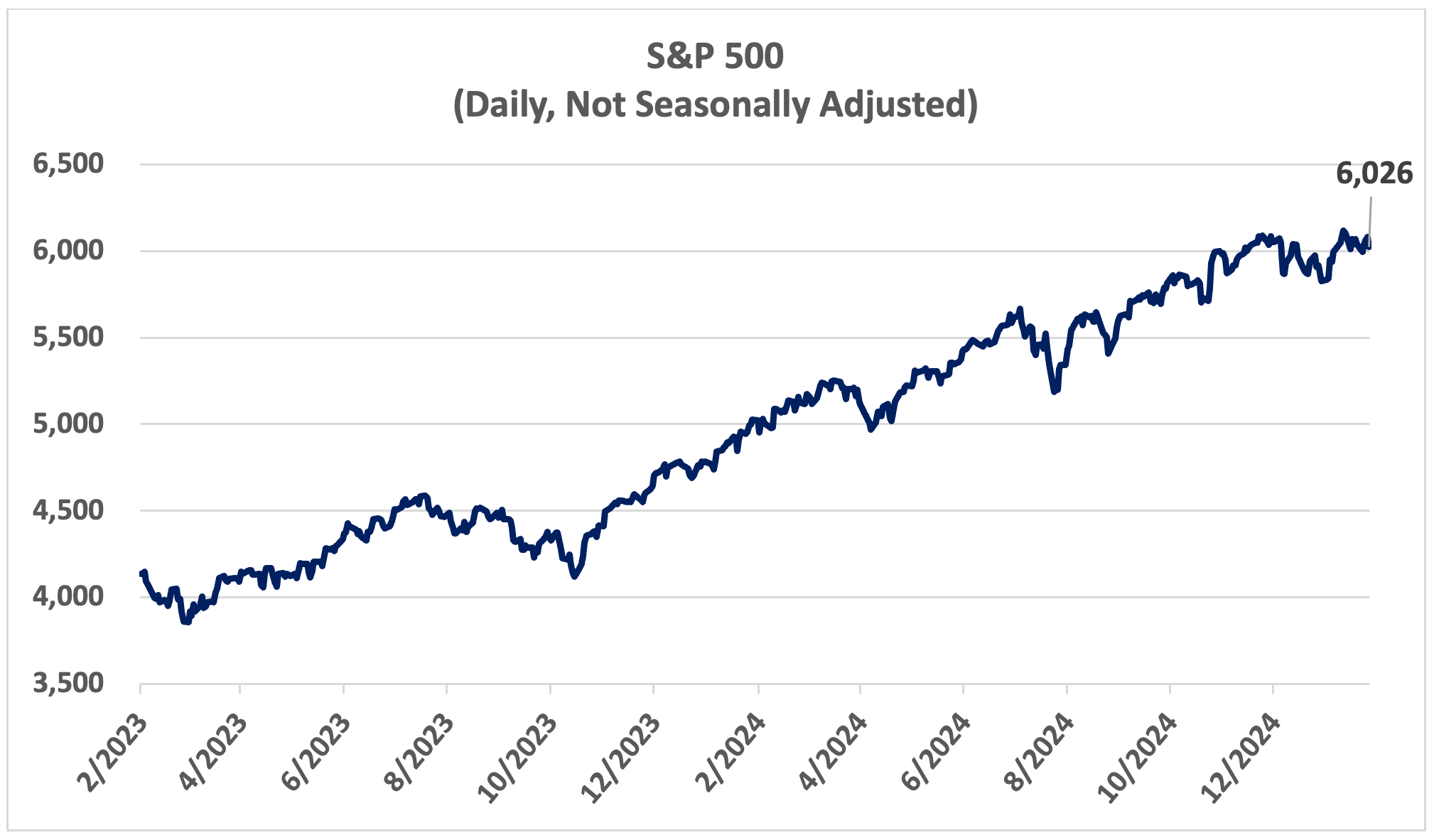

- Dow and S&P surge following Trump’s victory

- Bond market mixed, short rates down, long rates up

The stock market staged a most impressive rally following Donald Trump’s election win. The S&P 500 rose above 6,000 for the first time, and the Dow surpassed 44,000. The stock market has experienced significant volatility since then but has not re-established convincing upward momentum. A more relaxed regulatory environment and lower tax rates are positive influences on the stock market, but historically high valuations will constrain the scope of future gains. Stock investors are reacting to daily headlines of policy changes and initiatives. Policy uncertainty feeds into volatility and dampens investor optimism. Since multiples are already stretched, further appreciation will have to be supported by improved earnings. The S&P 500 is currently priced at about 30 times its 12-month earnings.

Short-term bond yields declined with the Federal Reserve’s rate cuts at the end of 2024. Intermediate-term rates had declined through September of last year in anticipation of cuts, then rose through the last quarter of 2024 and into early January. For much of early January, the yield on the 10-year Treasury appeared headed for 5%. It peaked at 4.8% and has since settled back to about 4.5%. The incoming Secretary of the Treasury has announced his intention to issue more intermediate-term bonds to fund US Government spending—his predecessor had favored the short end of the yield curve. All else equal, the issuance of more intermediate treasury bonds could prop up intermediate rates on bonds and other forms of credit that are benchmarked to treasuries. The bond market will need clear and convincing evidence of restraint on deficit spending before settling into sustainably lower rates.

Investors have enjoyed a wonderful period of strong returns on both stocks and bonds. The S&P 500 was up 26.3% in 2023 and 25.0% last year. After two years of miserable returns in bonds, intermediate bonds advanced through September 2024 before giving up ground in the face of rising intermediate rates at the end of 2024.

If we can help you navigate this changing business climate, please do not hesitate to contact your United Community banker. We appreciate your readership.

Learn about our economy expert.

-

This information is for informational purposes only and does not constitute investment advice.

Sources:

GDP – Bureau of Economic Analysis

Employment & Inflation – Bureau of Labor Statistics

Interest Rates – Federal Reserve

P/E S&P 500 – multpl.com

Non-Deposit investment products and services, and Insurance products and services offered through United Community Banks, Inc. are:• NOT Insured by FDIC or Any Other Government Agency;

• NOT Guaranteed by United Community Bank or any affiliate of United Community Bank;

• NOT a Deposit or Obligation;

• Subject to Risk and May Lose Value

This content is not intended as, and shall not be understood or construed as, financial advice, investment advice, or any other advice. This content is provided for informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. United Community shall not be liable for any damages of any kind relating to such information not as to the legal, regulatory, financial or tax implications of the matters referred herein. All views and opinions expressed are those of the writer/commentator and do not reflect the views or positions of United Community.